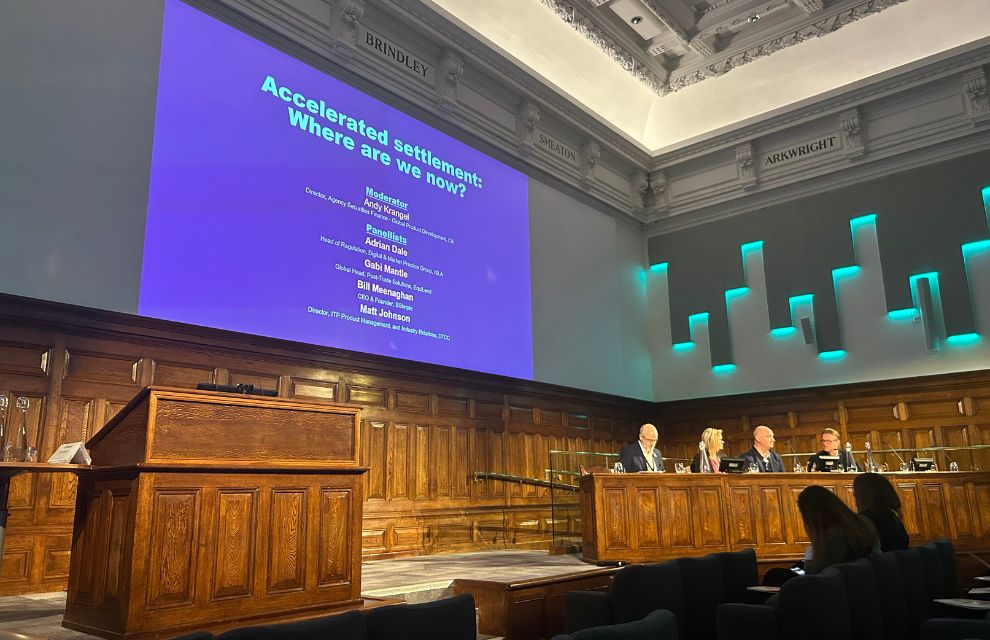

At the Securities Finance Symposium in London, four industry members argued that automation will be crucial for a smooth transition to a shorter T+1 settlement cycle in the securities finance industry. The panel was moderated by Adrian Dale, head of regulation, digital and market practice group at ISLA, who shared their experiences from North Americas successful shift to T+-1 in May 2024. Matt Johnson, director for ITP Product Management and Industry Relations at DTCC, highlighted the focus on regulatory backing in the US and the UK. Gabi Mantle, global head, Post-Trade Solutions at EquiLend, also highlighted the adoption of a more automated version of recalls, which saw volumes of recalls triple. Bill Meenaghan, CEO and founder of SSImple, suggested that automation would be key to overcoming challenges such as automating the entire process and allowing all industry access to the SSI data on a permissioned basis. Despite the emphasis on automation, Meenagh warned that it may not be finished by the end of 2027.

Source

This post was brought to you by Wrk. Our bot looks for news related to automation and post daily.